Bitcoin’s grinding tape, tamed volatility and repeated, incremental all-time highs are not symptoms of a failed cycle but evidence of a market changing hands and changing character, according to Alex Thorn, Galaxy’s head of firmwide research in an interview released October 23.

Bitcoin Bull Run Gone Quiet: Here’s Why

The researcher argues that the driver capping bitcoin’s near-term upside is exogenous—US–China tariff risk—rather than any structural deterioration in the asset’s fundamentals or adoption. “I don’t yet think it’s more existential than that for the bull market,” he said, describing the current price action as “sort of crab,” with the market “still” climbing a wall of worry.

The price discussion hinged on two linked observations. First, bitcoin is not trading like gold yet because “markets move on the margins,” and marginal flows still treat BTC as risk. Second, those margins are shifting, with passive, long-term allocators steadily absorbing distribution from older cohorts. “Significant distribution from old hands to new hands” has created resistance, he said, but that process is “healthy,” widening ownership and maturing the market. He framed a psychological and structural line of demarcation at six figures: “Maybe we delineate there the pre-$100K bitcoin world versus the post-$100K bitcoin world. I think it’s going to look a lot different.”

He contends gold’s behavior helps explain the present inter-asset divergence. “This still is the debasement trade…and it’s the anti-US government trade,” he said, noting that recent gold strength has been “all offshore,” with bids arriving “during European and Asian hours,” consistent with “foreign central banks and large…sovereign wealth funds” diversifying away from US exposure.

By contrast, the bitcoin price is pinned to risk appetite at the edges of the market. That said, he expects the asset to converge toward a gold-like profile as ownership migrates to institutions: “BlackRock’s chilling the digital gold narrative…Fidelity, this is how they talk about it,” he said, adding that as more supply moves into the hands of registered investment advisors and passive vehicles, BTC “will…trade a lot more like a risk-off, non-sovereign scarcity hedge asset.”

The near-term overhang, in his view, is the tariff scare that followed statements on October 10 about potential 100% levies on China, which “caused” a leverage washout and stalled a strong October. “Quite simply an abatement of the tariff war between the US and China…would sort of set us right back on course in risk markets,” he said, anticipating a compromise rather than a “protracted bloody trade war.”

Thorn also downplayed the next Federal Reserve meeting as a catalyst for bitcoin’s direction, while acknowledging that with official economic data delayed, the Fed’s own proprietary datasets could make its communication unusually market-relevant: “They’re going to have data. We don’t have data, but they’ll share the data.”

Galaxy Lowers EOY Bitcoin Price Prediction

Against that backdrop, he marked down—but did not abandon—his year-end targets. “At the beginning of the year, I was calling for $150,000 and then $185,000 in Q4… I am going to materially draw down that prediction to maybe like $130,000 by EOY,” he said.

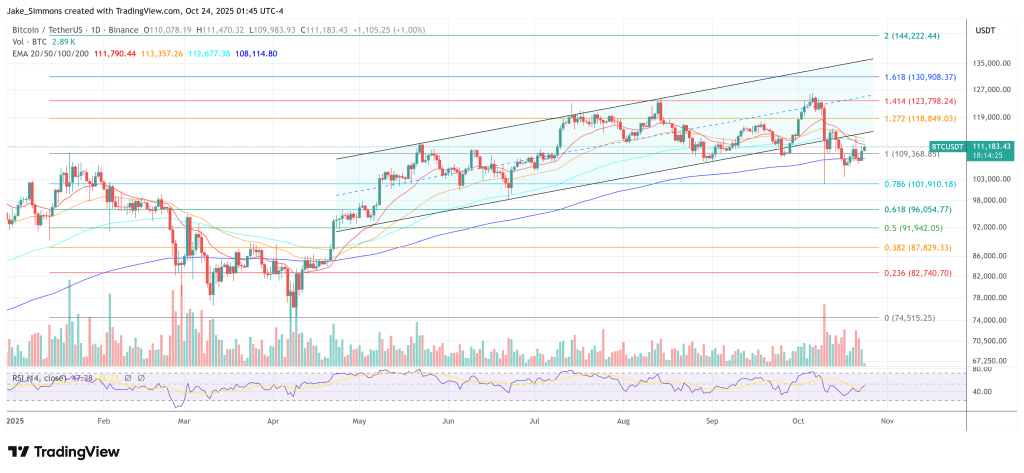

Thorn described 2025’s path as a slow, volatile stair-step higher—“from like $100k to…$74k to then $126k to now $108l”—with realized volatility declining. To illustrate the regime change, host Joe Consorti highlighted a 90-day realized volatility reading near 29, far below the 2017 and 2021 cycle peaks, and summarized the shifting drivers: “It’s more of a macro trade than anything…moving much further into…being impacted…by the macro regime.”

Institutional distribution channels were a recurring theme. The Galaxy research head pointed to wealth-platform access and custody bank initiatives as late-cycle but powerful accelerants. Thorn cited Morgan Stanley’s move to let advisors recommend a small allocation (2-4%) through spot ETFs and said that three of the four largest global custody banks have either launched or announced digital-asset custody, with one notable holdout.

The implication, he argued, is that the ETF bid and wirehouse adoption are replacing the old, concentrated holder base: “The era of the early bitcoin adopter is now finally, I think, fully coming to an end. And now you’re in…whatever that stage is…this is going to be a widely owned macro asset in everybody’s portfolio.”

NEW EPISODE: Over The Horizon

Alex Thorn (@intangiblecoins) joins me to discuss:

– Why markets are so anxious

– Institutional adoption and Bitcoin’s next era

– AI CapEx & lessons from the dot-com boom

– The future of digital asset treasuries pic.twitter.com/pVuKs3MWJH— Horizon (@JoinHorizon_) October 23, 2025

Macro cross-currents complicate the timing. The AI capital-expenditure boom—he called it “the most important trend in markets”—is either nearing a speculative blow-off or, in a more geopolitical framing, just entering a Manhattan Project–style national-priority phase. If the latter proves correct, the knock-on effects for liquidity, rates, energy and semiconductors could be larger and longer-lived than typical tech cycles.

But for bitcoin specifically, he kept coming back to tariffs as the decisive near-term swing factor and to microstructure as the reason the chart feels both heavier and sturdier than past cycles: a passive ETF bid absorbing OG supply at psychologically significant round numbers, without the “massive uplifts” that once followed fresh all-time highs.

The base case he outlined is not euphoria but endurance. Or, as he put it more bluntly earlier in the conversation, the bull run hasn’t died—“it’s evolving.”

At press time, BTC traded at $111,183.

+ There are no comments

Add yours