Matt Hougan, the chief investment officer at Bitwise Asset Management, said he thinks Solana could plausibly become a trillion-dollar asset within five years—an outcome that would roughly translate into a ~$1,600 SOL price on a simple market-cap-per-token basis, depending on circulating supply.

Hougan made the remarks on the Jan. 29 episode of When Shift Happens, framing his Solana view through what he called a “two ways to win” setup: growth in the addressable market (stablecoins and tokenized assets), plus an increasing share captured by Solana versus competing networks.

Why Solana Could Hit $1,600+ Within 5 Years

Hougan argued that the “infrastructure market” for stablecoins and tokenization is expanding quickly enough that large, liquid L1s should be valued less like niche crypto experiments and more like enabling rails for traditional finance. “The US Secretary of Treasury expects the stablecoin market to 12x over the next four years,” he said, adding that Larry Fink has described a future where “every asset, every fund, ETF, stock, bond, real estate will be tokenized.”

From there, his Solana thesis leaned heavily on relative positioning. Ethereum remains the incumbent in stablecoins and tokenization, Hougan said, but Solana is “a legit competitor with an interesting technological differentiation,” and crucially “it’s extraordinarily easy to use and the community has a ship first attitude.”

That usability point, in his view, is underpriced by investors who focus on benchmark-style comparisons. “I think ease of use is a killer app that’s underrated by investors,” Hougan said. “Investors like to talk about throughput and they like to talk… TPS… who cares about this? …For an end user who’s trading, who’s on-ramping, ease of use is the killer app. And Solana is just easy to use, just dead easy to use.”

Hougan also acknowledged a common investor blind spot: token supply dynamics can separate price action from market cap growth. He noted that Solana’s market value can rise meaningfully even if the token price revisits prior highs, and suggested staking yield partially offsets dilution, citing “roughly like 7% a year.”

Another thread in the discussion was how regulation shaped institutional behavior. Hougan said Solana’s footprint in stablecoins and tokenization was constrained during the prior US regulatory environment, arguing that institutions “couldn’t build on Solana” if they believed it sat “outside of the regulatory perimeter.” With that cloud lifting, he said, mandates are starting to broaden.

He also described why the ETF wrapper matters more for a smaller asset. “You put a little bit of inflows into an ETF package and they’re chasing a relatively small supply of Solana,” Hougan said. “It’s one of the best setups for an asset that I’ve ever seen because you have this small constrained size, you have significant institutional demand, you have stablecoins and tokenization… you put all that together and it seems like a winner.”

Still, he avoided hard price targets and instead stayed in market-cap terms. “In 5 years I think it could be a trillion dollar asset. I think that’s relatively easy to imagine,” he said. “It’s hard to give a precise target because it depends on the pace of growth on stablecoins and tokenization. It depends on whether Congress passes the Clarity Act. It depends on the sort of crypto market cycles.”

E156: @Matt_Hougan from @BitwiseInvest – $6.5M Bitcoin and the strongest Solana setup ever?

This might be the most bullish yet rational episode we’ve done on the future of crypto: why debasement, institutional flows & tokenization are just getting started.

Timestamps:

0:00… pic.twitter.com/WMqvKL7pCj

— MR SHIFT

(@KevinWSHPod) January 29, 2026

On simple market-cap math, a $1 trillion Solana valuation implies a four-figure token price depending on supply. The relationship is straightforward: token price equals market cap divided by supply. Using Solana’s circulating supply of roughly 566 million SOL, a $1 trillion market cap works out to about $1,766 per SOL ($1,000,000,000,000 ÷ 566,000,000).

If you instead use a fully diluted-style denominator closer to 619 million SOL, the same $1 trillion market cap implies roughly $1,615 per SOL ($1,000,000,000,000 ÷ 619,000,000). In other words, Hougan’s “trillion-dollar asset” framing maps to something like the mid-$1,000s per token on today’s supply assumptions, with the exact number moving as supply changes.

Notably, Hougan’s Solana call sat alongside a broader macro narrative he returned to repeatedly: monetary debasement pushing investors toward scarce and non-sovereign stores of value. On Bitcoin, he argued the “two ways to win” are the store-of-value market expanding and Bitcoin taking share from gold, an arc he said could drive multi-million-dollar BTC over decades if the last 10–15 years of adoption trends persist.

For Solana, the equivalent is less about being “digital gold” and more about becoming a primary venue for stablecoin flows and tokenized securities. If those rails scale and if Solana continues gaining share as a high-velocity, institution-friendly network, Hougan’s trillion-dollar scenario implies the market is still pricing the opportunity too conservatively.

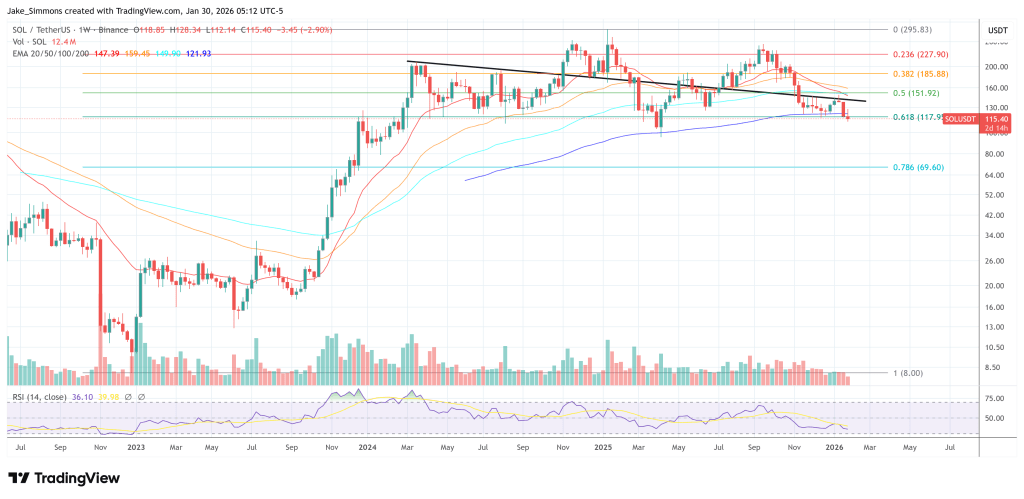

At press time, SOL traded at $115.40.

+ There are no comments

Add yours