One of the cleaner tells in crypto is when the old supply decides it’s time. Not “made a quick 20% and clipped it” time — years old.

That’s basically what Glassnode researcher CryptoVizArt flagged after an XRP wallet aged roughly 5–7 years (with a cost basis around $0.40) realized more than $721.5 million in profit on Dec. 11.

A single wallet doesn’t “break” a market on its own. But the timing is the point: this wasn’t profit-taking into a rip. It landed while XRP was showing weakness right at the $2.0 key level.

CryptoVizArt wrote via X: “On December 11th, a 5-7 year old XRP wallet address (with a cost basis of $0.4) realized over $721.5M in profit! A rare sizable profit-taking while the price shows weakness right at the $2.0 key level.”

What This Means For XRP Price

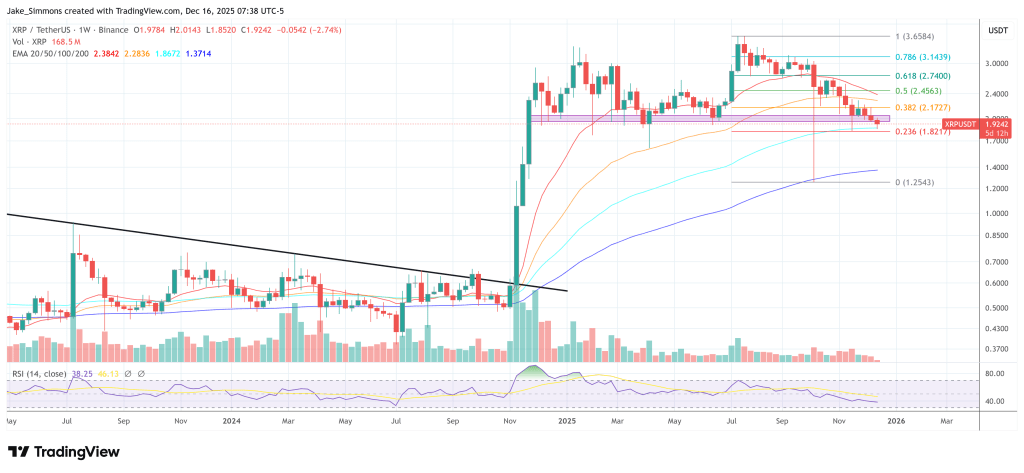

That $2 handle matters for the usual reasons — round number, obvious chart magnet, psychological line in the sand — but also because the market’s been treating it like a live wire lately. Since early December last year, the support zone between $2 and $1.90 has been tested endless times. XRP bulls always managed to close above the zone on the weekly timeframe.

So what does the $721M print mean? It’s a reminder that supply overhang isn’t theoretical. A 5–7 year wallet taking profits can be read as “de-risking,” sure. But in tape terms, it’s also distribution that the market has to absorb while price is already leaning. If bids are deep, it’s a shrug. If bids are thin, it turns $2 into a trapdoor.

And right now, “thin” is kind of the vibe across crypto, not just XRP.

CryptoVizArt’s broader framing from Dec. 13 is that the $80K–$90K Bitcoin consolidation is producing stress “comparable to late Jan 2022.” Via X, he wrote: “The current $80K–$90K consolidation range is generating a magnitude of stress comparable to late January 2022, with Relative Unrealized Loss approaching ~10% of market cap. This places the market in a regime where liquidity is constrained, and sensitivity to macro shocks is elevated, yet still below the levels typically associated with full bear-market capitulation.”

That backdrop matters because alts don’t trade in a vacuum. When the whole complex is jumpy, big sell events at key levels have more punch. Not because every XRP holder suddenly panics, but because market-makers and discretionary traders tend to pull risk at the same time. Spreads widen, depth thins, and “one-off” flows start to move price more than they should.

Still, it cuts both ways. A single, chunky realization can also be the market clearing a problem — old supply exiting, new demand stepping in, the kind of transfer that (eventually) makes a base sturdier. The trick is whether $2 holds while that handoff happens.

At press time, XRP was trading at $1.89, which could make Sunday’s weekly close another extremely important event.

+ There are no comments

Add yours