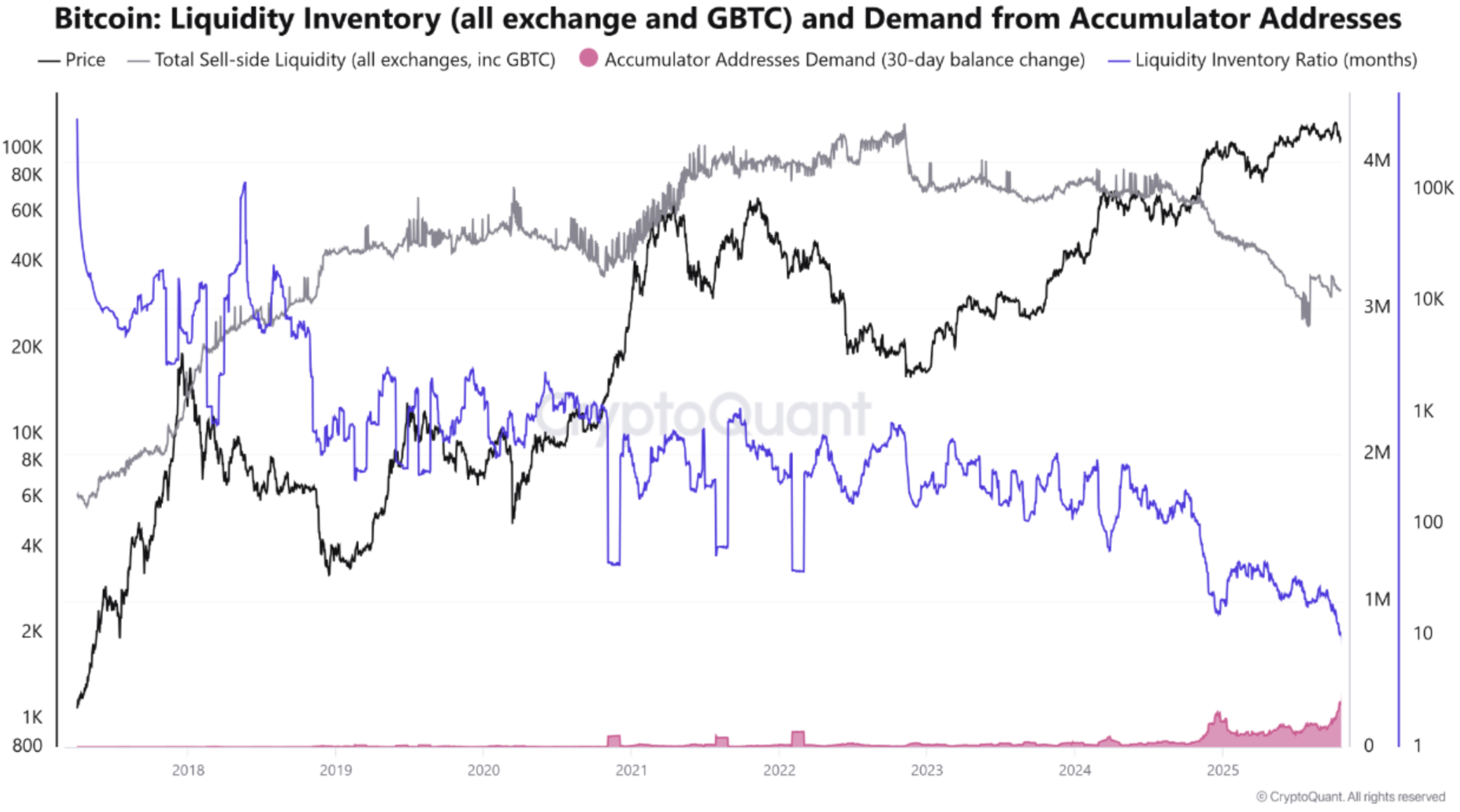

Bitcoin (BTC) liquidity is drying up fast, as the metric recently hit a seven-year low, reaching around 3.12 million BTC, the lowest level since 2018. This occurred as BTC continued to trade below the 99-day Moving Average (MA), located around $112,086.

Bitcoin Liquidity Dries Up Amid High Demand

According to a CryptoQuant Quicktake post by contributor Arab Chain, Bitcoin’s sell-side liquidity is drying up at a rapid pace, recently hitting a seven-year low at 3.12 million BTC.

As BTC’s supply tumbles sharply, the cryptocurrency is trading in the low $110,000 range, indicating a delicate balance between falling active circulating supply and growing institutional demand.

Latest on-chain data shows that demand for BTC from long-term holders’ addresses has been steadily rising. Over the past 30 days, long-term investors have accumulated 373,700 BTC.

Long-term investors accumulating BTC during the latest dip shows that there is sufficient market demand for the flagship cryptocurrency despite a volatile crypto market. Arab Chain remarked that the market is currently in a “quiet accumulation” phase ahead of a potential breakout.

The CryptoQuant analyst emphasized that the Liquidity Inventory Ratio (LIR) has crashed to around 8.3 months, suggesting that current market liquidity covers less than nine months’ worth of demand – confirming the rapid depletion in BTC’s sellable supply.

For the uninitiated, the LIR measures the balance between available liquidity and active trading demand in the market, showing whether market makers are providing sufficient depth relative to recent trade volume. A high LIR suggests ample liquidity and stable price movement, while a low LIR indicates thinner order books and higher vulnerability to volatility or slippage.

The medium-term outlook for BTC looks bullish, due to a combination of declining liquidity and growing demand from institutional and long-term investors. Arab Chain added:

If this trend continues through the end of the fourth quarter, Bitcoin’s price could surpass $115,000, especially if accompanied by rising buying flows from US investment funds and ETFs, supporting the continuation of the current bullish trend.

BTC Top Not In Yet

While some analysts predict that BTC may have already peaked this market cycle, others are confident that the top cryptocurrency is yet to hit its cycle high. Recent on-chain data indicates that BTC NVT Golden Cross is yet to enter the territory that marked previous cycle tops.

Similarly, fellow CryptoQuant analyst PelinayPA predicted that there is a 55% chance that Bitcoin has not yet topped for the current market cycle. At press time, BTC trades at $111,295, up 2.1% in the past 24 hours.

+ There are no comments

Add yours