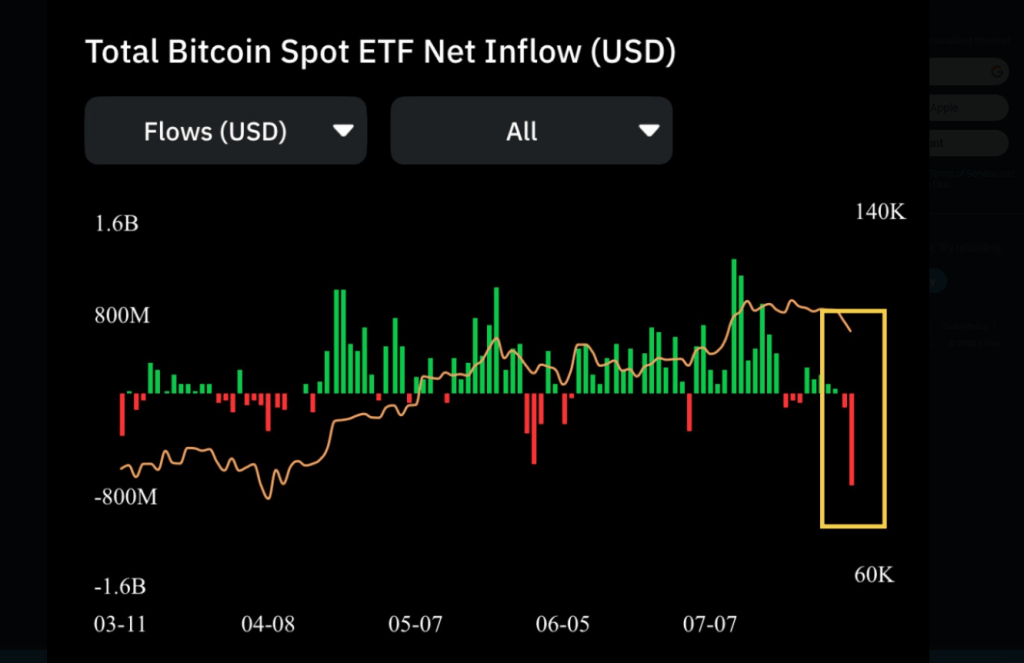

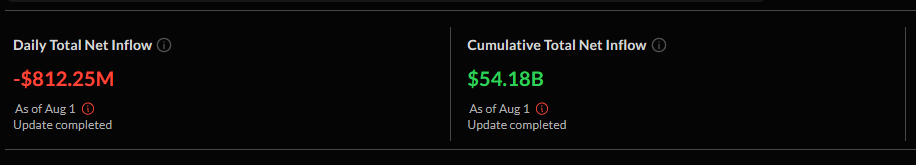

Reports have disclosed that spot Bitcoin ETFs experienced a massive institutional withdrawal last Friday, with investors pulling out over $800 million.

That outflow ranks as the second-largest one-day exodus in the history of these funds. It wiped out roughly one week’s worth of inflows and pushed cumulative net inflows down to $54 billion.

Spot Bitcoin ETFs See Major Withdrawals

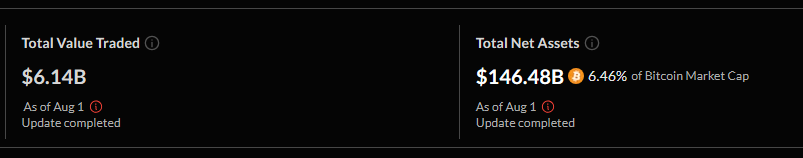

Based on reports, the total assets under management across all spot Bitcoin ETFs now stand at $146.48 billion. That represents just 6.46% of Bitcoin’s overall market capitalization.

Leading the sell-off was Fidelity’s FBTC, which saw redemptions of $331 million. Close behind was ARK Invest’s ARKB, with $327.93 million exiting the fund.

The Bitcoin ETFs had $812M worth of outflows yesterday.

The 2nd largest outflow day in history.

Should we be worried? pic.twitter.com/YdiPolJODE

— Mister Crypto (@misterrcrypto) August 3, 2025

Grayscale’s GBTC recorded $67 million in outflows, and BlackRock’s IBIT faced a comparatively small pull-back of $2.58 million.

Even with big redemptions, institutions have not stepped away completely. There is a sense that they are simply shifting tactics.

Trading Volumes Hold Up Strong

According to trading data, daily turnover across all spot Bitcoin ETFs surged to $6.13 billion on the same day. BlackRock’s IBIT alone accounted for $4.50 billion of that figure.

Such high volume suggests that buyers and sellers are still very active. It points to a market where investors are fine-tuning positions rather than abandoning them. Futures, discounted funds like GBTC, or alternative crypto products could be where some capital is moving.

Ethereum ETFs Break Inflow Streak

Reports have disclosed that spot Ether ETFs ended a 20-day inflow streak with net outflows of $152 million last Friday. That streak was the longest the Ether products have ever seen. Grayscale’s ETHE led the outflows with $47.68 million leaving the fund.

Bitwise’s ETHW saw $40.30 million in redemptions, while Fidelity’s FETH lost $6.17 million. BlackRock’s ETHA held steady, reporting $10.71 billion in assets under management.

Total trading across all Ether ETFs reached $2.26 billion, with Grayscale’s product making up nearly $290 million of that sum. The combined AUM for Ether ETFs now sits at $20 billion, equivalent to 4.70% of Ethereum’s market cap.

Two weeks earlier, on July 16, these same funds posted their highest single-day inflow of $727 million, followed by another $602 million on July 17.

Featured image from Meta, chart from TradingView

+ There are no comments

Add yours