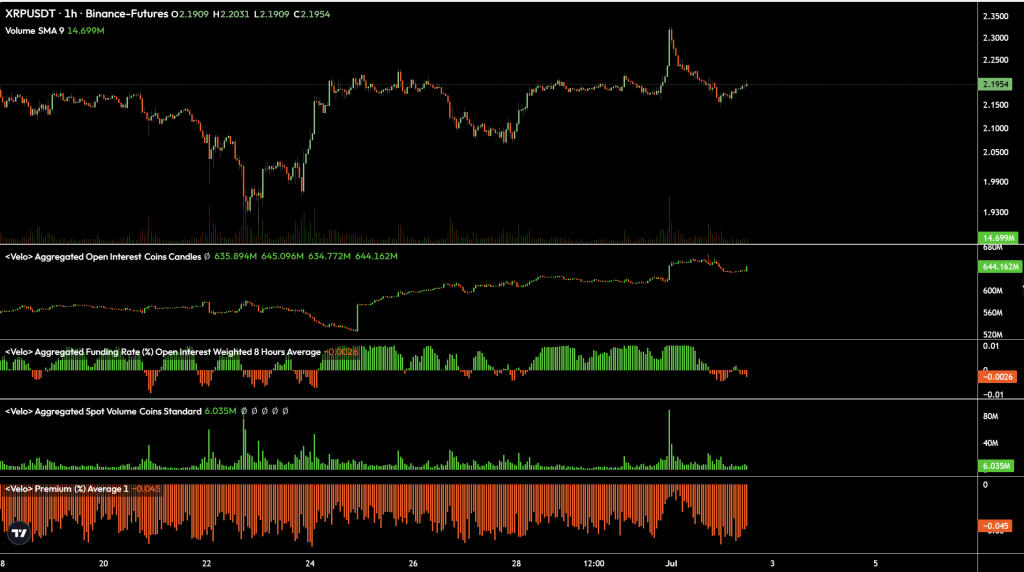

A growing number of technical signals suggest that XRP may be on the verge of a short squeeze, according to prominent crypto analyst CryptoInsightUK. In a post on X, the analyst highlighted key on-chain and derivatives data, painting a picture of dense liquidity stacked above current price levels, rising open interest, and a structure that resembles previous pre-squeeze conditions.

XRP Short Squeeze Incoming?

“Liquidity on the hourly is interesting,” CryptoInsightUK wrote, emphasizing what he described as “SUPER dense liquidity above us,” adding that in his view, “it’s inevitable this gets taken, probably sooner rather than later.” Accompanying images shared by the analyst indicate that the lower liquidity cluster sits around $1.90, while the upper zone—where a potential short squeeze could be triggered—concentrates around $2.40. The implication is clear: shorts are vulnerable to a cascade of forced liquidations if price begins to accelerate upward.

The analysis drew on data from @velo_xyz, showing that open interest has been steadily climbing since an unexplained spike on June 24. Notably, during this time, premium remained heavily negative, and funding rates oscillated between positive and negative. “This suggests to me there have been a net addition of short positions to the Open Interest for $XRP,” the analyst wrote, implying that a crowded short trade could now be structurally exposed.

Layering this with TradingDiff’s liquidity heatmap, CryptoInsightUK inferred that “we are at some point looking for a short squeeze here for XRP.” While the timing remains uncertain, the combination of rising open interest, negative premium, and dense liquidity above suggests growing asymmetry in risk for short sellers.

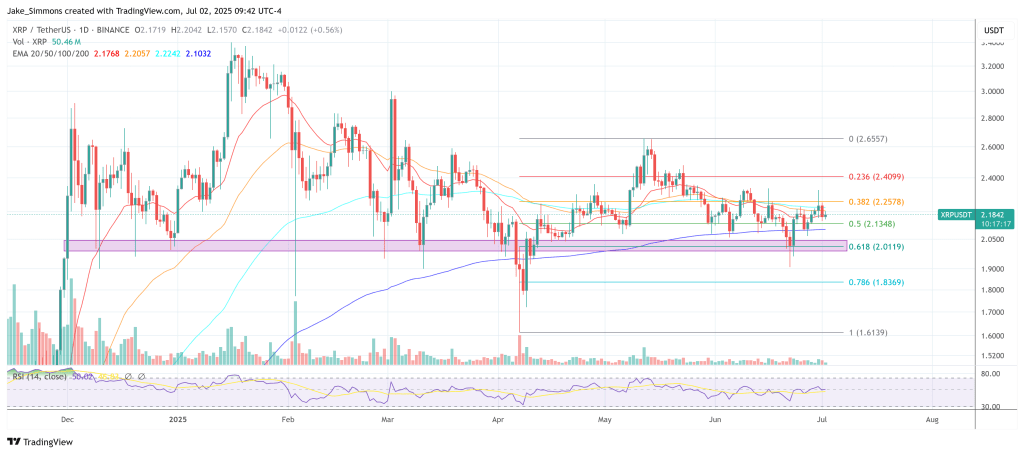

Still, the analyst added a critical note of caution. “Both ETH and XRP on the daily do have some liquidity below us,” he said, acknowledging the possibility of a fakeout or liquidity sweep downward before any aggressive upside movement. “As you guys know, it is possible to leave some liquidity behind as some people win their trades. BUT, we cannot count this out.”

A final observation focused on Ethereum’s changing liquidity landscape, which may have broader implications for the market as a whole. “Something has changed on ETH,” CryptoInsightUK wrote. “If we look to the liquidity above us we can see the Red has turned Yellow.” He interpreted this shift as a possible signal that shorts are being closed, or that new longs are building below the current price, thereby visually reducing the intensity of liquidity above.

Whether XRP can reach the $2.40 liquidity pocket remains to be seen, but the fuse may already be lit. At press time, XRP traded at $2.18.

+ There are no comments

Add yours