The latest webcast from the market commentator known as Crypto Insight UK centres on a single contention: the technical and fundamental backdrop for XRP now mirrors the pre-euphoric set-ups that propelled the token from $0.50 to $2.70 in four weeks during 2021, and it could drive a surge “towards eight, nine, ten, eleven, twelve dollars in the very short term.”

When Will XRP Hit $12?

The analyst began with Bitcoin, because “Bitcoin price action correlates [with] the rest of the market, at least at the minute, before we start to see dominance breakdown.” Last week’s candle, he notes, was the highest weekly close ever recorded by the benchmark asset, yet—critically—the weekly relative-strength index has not entered the overbought zone. In prior cycles, the RSI’s passage into that territory “is when we start to get this mania push-up” that drags alt-coins with it. XRP’s own history is invoked as corroboration: “When we got the weekly into the overbought, that’s when we went from fifty-cent up to $2.70 in the space of like four weeks.”

The analyst then drills into order-book heat-maps. Above Bitcoin price lies what he calls a “dense liquidity” cluster, most prominent around $130,000. A matching reservoir sits below, first at $100,000 and then at $93,000. “If we get a pull-back into this $100K level, I will start to heavily position in leverage in altcoins,” he tells viewers, adding that a deeper flush to $93,000 would see him “continue to add to my positions.”

The market, he argues, is trapped in a self-reinforcing liquidity cycle: each test of overhead supply squeezes shorts, price consolidates, fresh liquidity builds at the new ceiling, and the pattern repeats until a catalyst—a macro loosening of money, a geopolitical shock, or a technical breakout—propels Bitcoin into the next tranche. A sustained move through $130,000, he contends, would likely be that catalyst and would “probably” mark the formal start of alt-season.

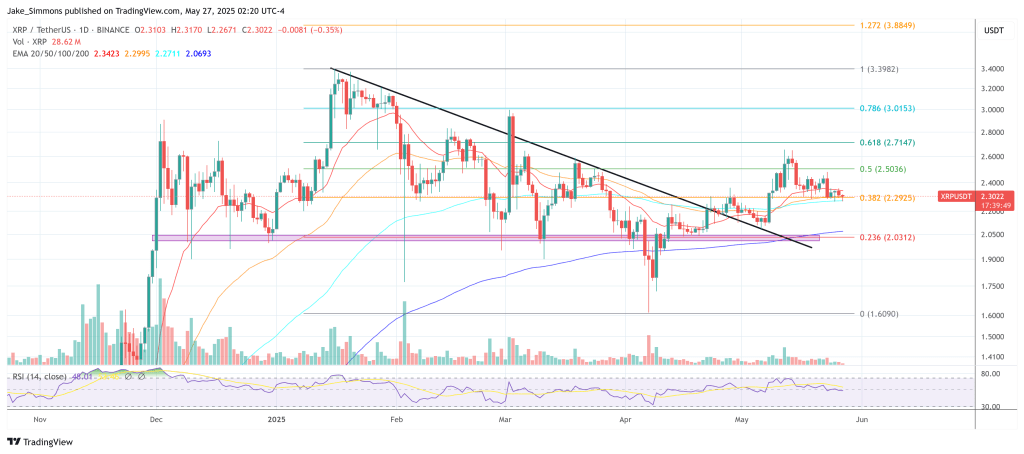

XRP’s chart is examined through a similar lens. Price has pushed out of what he labels a Wyckoff accumulation range, broken structure to the upside, and is now “finding support on previous resistance” inside a broad bull-flag. On the weekly ratios—XRP/Bitcoin, XRP/Ether and XRP dominance—momentum is quietly inflecting: “We’re starting to get bullish divergences, which is where we see higher lows on the RSI and lower lows in price action … it’s telling us the sellers are running out of steam.” He identifies a descending trend-line capping the consolidation; once that line breaks, he anticipates “an aggressive move back to the upside for XRP.”

XRP Price Catalysts

The webcast’s second movement shifts from charts to narrative catalysts. Here the analyst reels off a series of developments he regards as unusually synchronous. Reece Merrick, Ripple’s managing director for the Middle East and Africa, has just unveiled a partnership with the Dubai Land Department that tokenises real-estate title deeds on the XRP Ledger, a choice the press release describes as grounded in the chain’s “decade-long reliability.”

Ripple has closed its acquisition of Hidden Road, a prime brokerage whose name appears in DTCC documentation that references both XRP and XLM for cross-chain settlement. The firm, he reminds viewers, also holds “the full crypto payments license and settlement ability in Dubai.”

Speculation that Ripple might purchase Circle—the issuer of USDC—for about $11 billion, though unconfirmed, is folded into the same bullish mosaic, as is the launch of Ripple’s own RLUSD stablecoin and talk of a looming XRP spot-ETF.

Brad Garlinghouse himself, the analyst notes, chose ETFs as the single topic for last Thursday’s edition of Ripple’s “Crypto in a Minute,” having already mused on a podcast that an approval could arrive in July. In Washington, the analyst is watching for passage of the GENIUS stablecoin bill, timing he calls “very convenient” for RLUSD. Even the on-going SEC litigation—Judge Analisa Torres recently rejected the agency’s procedural bid to bring the penalty phase to a close—is framed not as a hindrance but as a potential upside catalyst once resolved.

Taken together, he argues, these technical and narrative strands form a spring: “What I’m basically trying to set you up for here, guys, is a succession of positive narratives that will squeeze XRP’s price higher as we move into price discovery.”

Yet his crescendo is tempered by disciplined risk management. He illustrates the peril of euphoria with hypothetical road-maps: Bitcoin might gallop to $150,000 or $170,000 and then recoil 18%; altcoins could shed twice that. Under one XRP scenario, an advance to $12 is followed by a 64% retracement to $4.50. “Take some money off the table,” he urges, because unrealised gains “aren’t good for anybody.” Profits banked at interim targets equip the trader both to enjoy further upside and to “reallocate if we get a pull-back.”

At press time, XRP traded at $2.30.

+ There are no comments

Add yours